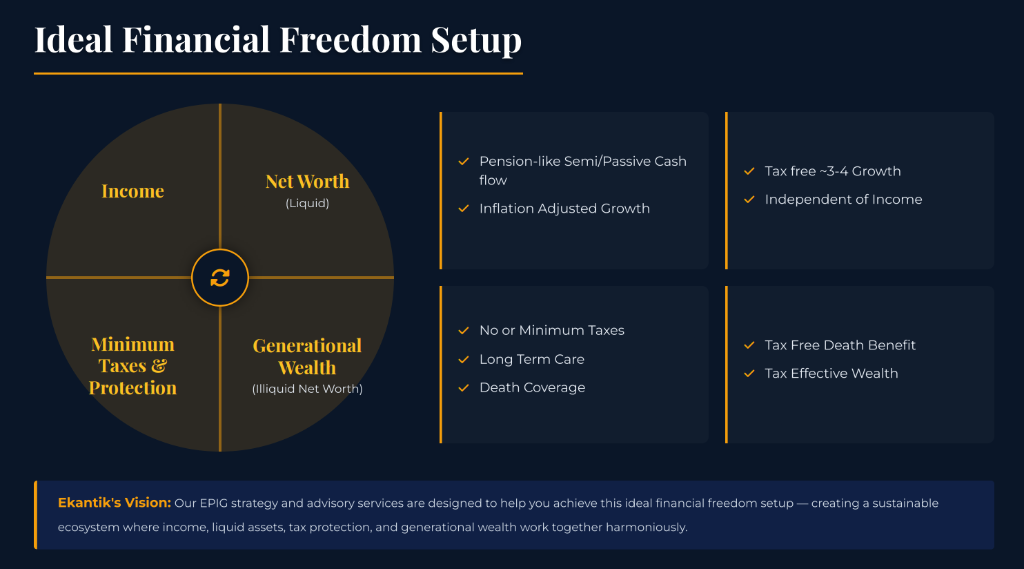

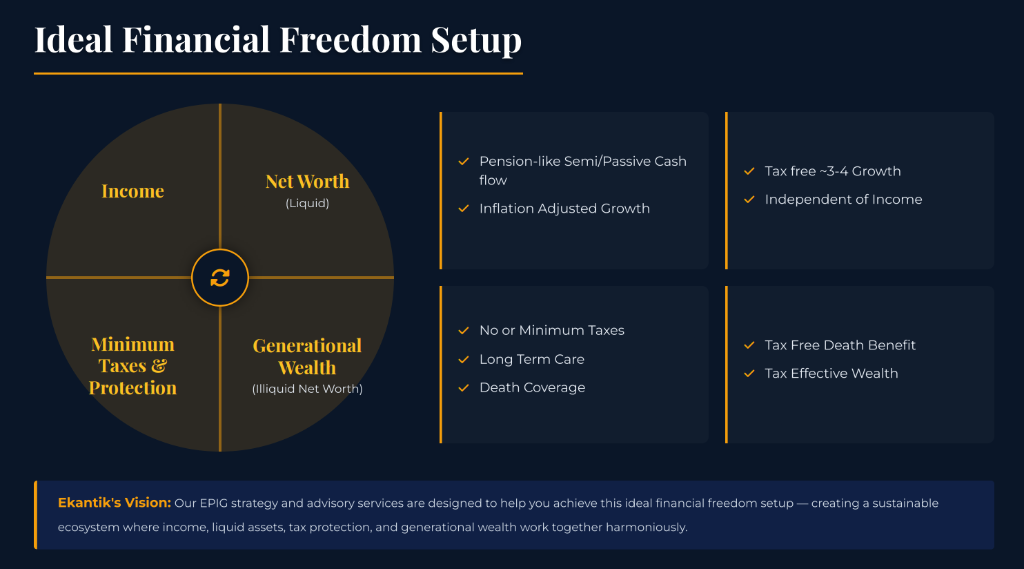

Ideal Financial Freedom Setup

The four pillars of true financial independence—income, liquidity, protection, and legacy.

Two complementary strategies for wealth preservation and tax-efficient growth toward your 10-year wealth goals: cash flow without selling assets + growth without maximum risk.

The four pillars of true financial independence—income, liquidity, protection, and legacy.

The ECA wealth-building system is designed to achieve all four quadrants through a tax-efficient, income-generating cycle.

Our proprietary wealth-building cycle delivers Income, Liquidity, and Legacy outcomes.

Success requires understanding the universal path to freedom—and the mindset that makes it real.

Financial freedom means reliable support income covering essential expenses with a safety margin—while preserving liquidity and resilience.

Most ECA clients arrive at Phase 3 or 4—you've stabilized cash flow, built savings, and now have investable capital ($100K+) ready to deploy. The question isn't how to save—it's how to preserve and grow what you've built in the most tax-efficient, durable way possible. Our focus is wealth strategy execution, not basic financial planning.

"Stop the bleeding. Make life predictable."

"Surplus is the seed of freedom."

"Structure matters as much as returns."

"Protect freedom from bad years."

"Freedom becomes responsibility."

Here's a real-world example of the constraint-based system that makes financial freedom possible.

A baseline you can maintain + extra deposits in strong months = a reservoir you can access without permanently draining your base.

This is why "save what's left" usually fails—as your income grows, lifestyle expenses creep up to consume the surplus. Willpower alone can't compete with this structural tendency.

Floor + Surge is a constraint-based system that reverses the equation: you commit to a baseline contribution first, then layer on additional deposits during strong cash-flow months. The system creates the discipline that motivation cannot sustain.

A fixed annual amount you can always fund, even in a rough year. This becomes your non-negotiable minimum—the foundation that compounds regardless of income volatility.

When cash flow grows—bonuses, business profits, windfalls, strong performance years—you layer on additional deposits. This captures upside without creating unsustainable obligations.

Over time, you build a reservoir that supports opportunities, absorbs emergencies, and provides retirement flexibility—all while your base continues to compound.

Traditional savings accounts are designed for accumulation—every withdrawal permanently shrinks the pile. You're always choosing between liquidity and growth.

A reservoir is different. It's engineered so that accessing liquidity can be treated as financing rather than permanent withdrawal. This means your base can keep compounding even when you need to tap it—though access has real costs and requires responsible management. You get both: growth potential and liquidity when opportunities or needs arise.

You want a system over motivation—structure that creates discipline automatically

You have income upside—variable comp, business profits, or growing earnings

You value liquidity + stability—want both access and compounding, not either/or

This is not a "hack" or loophole. Accessing your reservoir has real costs—interest, opportunity cost, and potential impact on long-term growth if not managed responsibly. Outcomes depend on proper design, ongoing maintenance, and disciplined use. This approach works best when engineered correctly and monitored regularly. Consult with qualified financial, tax, and legal professionals before implementing any wealth strategy.

How do you actually build this reservoir? Two complementary engines: cash flow today + growth forever.

Quarterly cash flow designed to support your lifestyle today—without forcing liquidation of long-term growth assets.

Aims to generate targeted quarterly distributions (6% per quarter, equivalent to 2% monthly) for consistent income

Strict 2.5% daily risk limit enforced at broker level to control volatility and preserve principal

Builds $1,200 safety buffer before distributions begin, retained as ongoing protection against market swings

Distributes targeted 6% quarterly while retaining surplus to compound your safety buffer and upside

Distributions pause automatically during losing quarters to rebuild buffer—prioritizing long-term stability over short-term payouts

The first priority: accumulate a $1,200 safety buffer before any distributions begin. No management fees are charged during this buffer-building phase. This typically takes the first quarter or two.

Daily 2.5% max equity risk limit enforced at broker level, designed to keep volatility contained

Once the buffer threshold is met, quarterly distributions begin at a preferred rate of 6% per quarter (equivalent to 2% monthly). Example: On $20,000 capital, target preferred distribution is $1,200 per quarter after buffer establishment. Paid at quarter-end if earned.

Strategy targets a ~10% gross quarterly return to support the 6% preferred distribution plus buffer retention and fees. Actual distributions fluctuate based on quarterly performance; excess profits are retained to strengthen the safety cushion.

In quarters with losses, distributions pause automatically and the strategy focuses on rebuilding the buffer. This disciplined approach prioritizes capital protection and sustainable long-term distributions over short-term payouts.

Buffer builds to $1,200 threshold. No management fees are charged during this buffer-building phase. No distributions during this phase.

Target $1,200 per quarter distribution (6% quarterly, equivalent to 2% monthly). Example: On $20,000 capital, target preferred distribution is $1,200 per quarter after buffer establishment. Paid at quarter-end if earned.

Targeted Returns Are Not Guaranteed. The 6% quarterly distribution target and 10% gross quarterly performance targets are goals, not promises. Actual results will vary.

Trading Involves Risk. All trading strategies carry the risk of loss. You could lose some or all of your invested capital. Past performance does not indicate future results.

Distributions May Be Paused. During market drawdowns or losing quarters, distributions will be suspended while the buffer is rebuilt to protect your capital.

Not Tax or Legal Advice. This strategy description is educational. Consult qualified tax, legal, and financial professionals before making investment decisions.

ECFS is designed to produce periodic income and reduce the need to sell long-term holdings. It prioritizes capital protection, process discipline, and buffer mechanics—complementing your long-term freedom plan by covering lifestyle cash-flow needs today.

A rules-based S&P 500 strategy that matches market performance in bull years and shifts to 0% cash in down markets—delivering outperformance through drawdown avoidance, not market timing.

Matches S&P 500 in bull markets (e.g., +31% in 2019, +28.7% in 2021), shifts to 0% cash in down markets—avoiding losses like -37% (2008), -4.4% (2018), -18.1% (2022)

Binary Risk ON/OFF "light switch" approach reacts to trend signals with discipline—no emotional decision-making, no market forecasting

0.5%–1% risk per trade framework keeps individual position losses small while targeting outsized gains in favorable conditions

Built on SPY and/or S&P 500 futures for efficient execution, transparency, and institutional-grade liquidity

2015–2026 backtest: 16.1% CAGR (+2.6% alpha from crash avoidance). Avoided 3/11 down years (2008, 2018, 2022) by shifting to cash. Simulated "Lost Decade" 2000–2010: 9.3% CAGR vs S&P 0.4%

Avoiding large drawdowns (-37% in 2008, -4.4% in 2018, -18.1% in 2022 by going to cash) preserves capital and improves long-term compounding

Strategic allocation balances safety with growth potential, using SPY as core holding while futures & options enhance returns.

Core holding in S&P 500 ETF or cash during risk-off periods

Efficient market exposure with controlled risk overlay

High-quality individual stocks for additional alpha

Note: Allocation shifts dynamically based on market conditions—moving to 100% cash during high-risk periods to preserve capital.

When corrections exceed 10%, move to cash to preserve capital and avoid the wealth-destroying drawdowns

Systematic rules identify high-probability entry points near market bottoms for optimal re-entry timing

Each position risking approximately 1% based on proprietary strategy, ensuring controlled exposure

This approach allows tactical market taking with lower risk, targeting superior risk-adjusted returns

"You can't win the game until you keep from losing it."

Match the market in UP years + Go to 0% in DOWN years = 16.1% CAGR vs 13.5% over 11 years

Full S&P 500 participation when markets rise

Move to 100% cash when corrections exceed 10%

EPIG 500 (Hypothetical): $243,960 (9.3% CAGR) | S&P 500: $104,076 (0.4% CAGR) | Advantage: +$139,884 (+8.9% alpha)

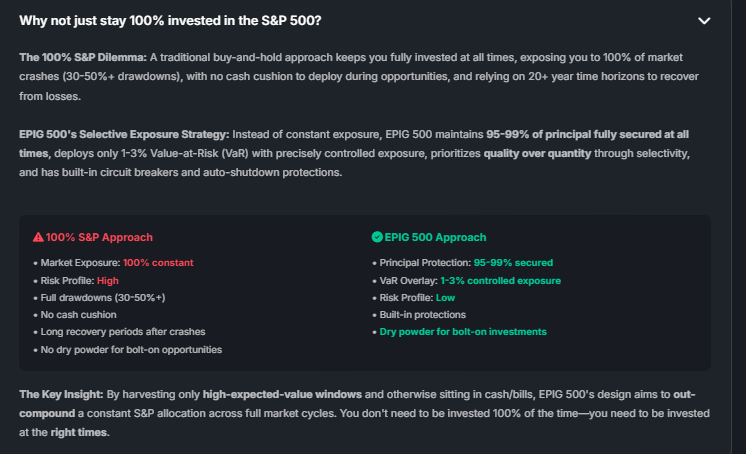

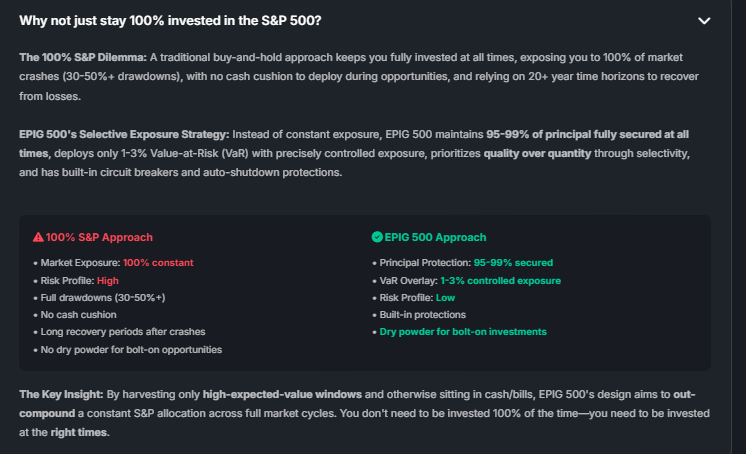

Understanding EPIG 500's Selective Exposure Strategy vs Traditional Buy-and-Hold

By harvesting only high-expected-value windows and otherwise sitting in cash/bills, EPIG 500's design aims to out-compound a constant S&P allocation across full market cycles. You don't need to be invested 100% of the time—you need to be invested at the right times.

Backtested/Hypothetical Results Only. All performance data shown is derived from backtesting and simulations using historical market data. These are not actual trading results. Backtested performance is developed with the benefit of hindsight and has inherent limitations.

Past Performance Does Not Predict Future Results. Historical backtests do not guarantee similar outcomes in actual trading. Market conditions change, and actual results may differ materially—including losses.

No Guarantee of Target Achievement. The strategy targets asymmetric capture (S&P +5% up, 0% down) but these are goals, not promises. Actual results may underperform, and capital losses are possible.

Not Investment, Tax, or Legal Advice. This description is informational and educational only. It does not constitute investment advice, a recommendation, or an offer/solicitation. Consult qualified professionals before making decisions.

Freedom Now (ECFS) covers lifestyle cash flow needs today. EPIG 500 compounds your long-term wealth engine by reducing the "volatility tax"—prioritizing drawdown defense to improve multi-decade compounding. Together, they form the complete "Now & Forever" system.

Every decision, every structure, every tool is guided by three core principles—designed to deliver freedom without fragility.

You've explored the Floor + Surge system, ECFS for cash flow, and EPIG 500 for growth. Here's WHY we built it this way.

Income that is repeatable and predictable—not dependent on market timing or forced liquidation. That's why ECFS builds a buffer first.

Wealth that compounds over time without maximum risk or excessive leverage. That's why EPIG 500 prioritizes drawdown defense.

Capital designed to survive volatility and remain resilient across cycles. That's why Floor + Surge creates a liquidity reservoir.

This philosophy guides how we structure income (ECFS), growth (EPIG 500), liquidity (Floor + Surge), and legacy—without forcing you into liquidation timing or fragile market bets.

Layer multiple forms of leverage so each layer amplifies the next—creating upward compounding over time.

Let's verify this approach aligns with your wealth goals and timeline.

Each layer strengthens the one below it.

What would these approaches mean for your specific situation? Model your numbers, see your outcomes, understand your path forward.

You've learned about ECFS (cash flow today) and EPIG 500 (growth forever). Now model your specific situation: your age, your capital, your timeline, your goals. See how different approaches create income, liquidity, and legacy outcomes tailored to your life.

Compare two paths: Direct investing (traditional) vs. Whole Life + EPIG borrowing (reservoir approach). Adjust every variable to match YOUR reality—then see which path aligns with your freedom goals.

Every number below can be adjusted. Start with the defaults to see an example, then customize to match your actual situation—your age, capital, income needs, and goals.

Invest full annual contribution directly in EPIG. Pay taxes at exit. Use 70/30 split for income vs liquidity.

Plan 1 Strategy:

• Invest 100% of annual contribution directly in EPIG

• Pay capital gains tax on profits when liquidating

• Split after-tax capital: 70% annuitized, 30% liquid fund

Pay annual premium to policy. Borrow specified % and invest in EPIG. Pay loan interest. Tax on liquidation.

Plan 2 Strategy:

• Pay annual premium to whole life policy (builds cash value)

• Borrow specified % from policy and invest in EPIG

• Pay interest on outstanding loan balance

• Pay capital gains tax on EPIG profits when liquidating

• Annuitize Net EPIG for income + keep death benefit

Click Calculate to see your results

Wealth preservation and growth frameworks to execute your 10-year charter using EPIG 500, ECFS, and tax-efficient structures

You learn what to do—but not how to execute, optimize, or adapt as markets evolve. Wealth goals remain theoretical.

We provide ongoing education, live cohort support, and proven frameworks—so you systematically execute your 10-year wealth goals with precision.

Track what matters: Investment Capital, Risk Capital, Cash Flow Generation, and Compounding—with personalized quarterly targets

Master the LAA→NEV→CED→ENW cycle: Leverage assets, eliminate waste, compound discretionary dollars, grow net worth systematically

Prioritize with clarity: Survival → Emergencies → Discretionary → Big Tickets → Savings → Risk Capital—the pyramid that builds resilience

Think like a corporation: multiple income streams, tax optimization, compounding systems—not just salary and savings

Evaluate opportunities strategically: High-probability high-payoff (real estate, skills) vs. low-probability gambles (lottery, speculation)

Tax-advantaged deployment strategies—whole life mechanics, entity structuring, tax deferral techniques—to maximize net wealth accumulation

Exclusive founding member cohort with structured curriculum, downloadable frameworks, and peer accountability

Regular cadence of live workshops, Q&A, and deep-dives—recorded and archived for on-demand access

Track your progress against personalized Financial Freedom KPIs—iterate, improve, and stay accountable

Plug-and-play spreadsheets, checklists, and calculators—no guesswork, just execute

Founding members gain lifetime access to evolving education, frameworks, and community support. As financial tools, tax laws, and opportunities evolve—you evolve with them.

You're not buying a strategy. You're joining a financial freedom operating system.

Limited founding memberships available—reserve your spot to access the full education ecosystem

Lock in lifetime benefits available only during our founding member period

Flat annual fee locked in forever — no matter how large your portfolio grows. Your rate is set today and protected against future increases.

Earn toward $0 annual fees forever. When you hit specific wealth goal milestones, your advisory fees can be eliminated permanently.

Exclusive access to Financial Freedom Operating System: Private Skool community, live Zoom workshops, quarterly KPI reviews, and framework templates.

We act as your complete fiduciary partner, coaching you toward self-sufficiency. Success means you can eventually manage wealth independently or hire your own strategist.

Shape the firm's direction. Founding members receive priority access to new strategies, direct communication channels, and meaningful input on future offerings.

Limited spots available

$1MM portfolio → ~$20-30K annual coordination fees based on the 0.75%-2.5% industry standard, potentially more with account minimum fees and transaction charges.

~$259,038 less over 10 years compared to founding rate

By Year 10, you've paid over $250K+ (25%+ of initial portfolio) in cumulative fees. After 20 years, fees approach or exceed the required capital itself—a "volatility of capital" problem for financial freedom.

Standard members pay ongoing fees indefinitely. No pathway to $0 fees, regardless of financial milestones achieved.

Standard advisory service without lifetime education. No access to exclusive Skool community, Zoom workshops, or framework templates available to founding members.

Service availability subject to capacity constraints. No priority access to new strategies or input on firm direction.

Founding memberships are strictly limited to ensure personalized service quality and maintain the exclusivity of the education community. Once capacity is reached, this opportunity closes permanently—future clients will pay higher fees and miss lifetime access to the Financial Freedom Operating System.

Beyond capital requirements and strategy fit, we're seeking founding members who share our values and vision for a long-term partnership.

You're not looking for a transactional relationship or a quick trade. You understand that building meaningful wealth takes time, discipline, and mutual commitment. You're seeking a multi-year, potentially generational partnership where success is shared and aligned.

You value open communication, honest disclosures, and transparency over marketing hype. You appreciate that despite both the upside potential and the risk controls—nothing hidden, no fine print surprises. Trust is earned through clarity, not promises.

You understand that all investing involves risk—including possible loss of principal. You're not looking for guarantees or "sure things," but rather for a disciplined, first-principles approach backed by risk management and risk controls. You accept that targets are aspirational, not guaranteed.

You understand the "autopilot analogy": 17 years of R&D, simulation, and stress testing creates a more reliable system than blind "luck." You value rigorous methodology, documented failure modes, and detailed risk controls over decades of audited history. You recognize that every successful strategy started at the founding stage—and launching early, after the system is certified, offers asymmetric upside.

You see the value in being early. You recognize that founding-stage terms, locked-in fees, and asymmetric upside represent a unique opportunity that won't be available once the strategy scales. You're willing to partner at the ground floor in exchange for permanent advantages.

You have at least $100K in liquid investable capital (ideally $250K+), and you're seeking either pension-like cash flow or long-term wealth building. You value transparency, risk management, and complete alignment of interests over marketing promises.

We're laser-focused on wealth preservation and growth execution. Here's exactly what we do—and what we don't.

We take your existing capital ($100K+) and deploy it systematically through EPIG 500, ECFS, and tax-efficient structures (whole life, etc.) to hit your 10-year wealth targets.

We manage specific strategies (EPIG 500 risk controls, ECFS monthly distributions) with ruthless discipline—monitoring, rebalancing, optimizing tax efficiency—so you don't have to.

We define clear wealth goals upfront (e.g., "Grow $250K to $1M by 2035"), then execute systematically with quarterly reviews to track progress and adjust strategy.

We don't create budgets, optimize cash flow, or teach basic savings discipline. We assume you've stabilized your financial life (Phase 1-2) and are ready to deploy capital (Phase 3+).

We use whole life as a wealth tool, not for insurance needs analysis. We don't draft estate documents (you need an attorney) or recommend homeowners insurance (you need an agent).

We structure strategies for maximum tax efficiency, but we don't prepare tax returns. You'll need a CPA to execute filings based on our strategy.

We're not passive portfolio managers. EPIG 500 requires active risk management; ECFS requires monthly monitoring. We're hands-on strategy executors, not asset-gatherers.

Everything you need to know about Ekantik Capital Advisors and our founding member program

Learn how to begin your journey, understand the process, and know what to expect

Getting started is simple and structured:

No Obligation Consultation: Your initial consultation is completely free with no pressure or commitment required.

Schedule Free ConsultationWhat ECA Does: We partner with clients who have $100K+ in investable capital and a clear 10-year wealth goal. Our focus is wealth preservation and tax-efficient growth using EPIG 500, ECFS, and strategic structures (whole life, etc.). We are NOT comprehensive financial planners—we assume you've handled cash flow stability, basic insurance, and estate documents. Our role is to deploy your capital strategically to hit your wealth targets.

For eligible investors*, Ekantik Capital Advisors offers a small flat fee per year which will remain constant until wealth goal achievement. When you achieve your 10-year wealth targets, you have the option to hire an investment strategist to continue managing your wealth independently.

Why This Matters: Unlike traditional advisors who charge fees based on assets under management (which increase as your wealth grows), our flat fee structure aligns with your goal of financial independence—not perpetual dependency.

*Eligibility Requirements: At least $100,000 in investable capital and $10,000 in risk capital

Your journey to financial freedom follows a structured 5-step process:

Comprehensive financial analysis and goal assessment to understand your current position and desired outcomes.

Personalized plan combining ECFS, EPIG 500, and other tailored strategies based on your risk capital, time horizon, and freedom goals.

Execute your wealth-building strategy with expert guidance, including account setup, capital allocation, and system activation.

Ongoing optimization, performance monitoring, and quarterly reviews to ensure you stay on track toward financial freedom.

Achieve sustainable, independent wealth where your support income covers expenses with a safety margin (FCR ≥ 1.25).

Timeline: Most clients complete the full implementation within 12-14 months. The initial consultation is risk-free and allows you to fully evaluate our approach before making any commitment.

Your first year with Ekantik Capital Advisors is structured in three progressive phases designed to build trust, establish infrastructure, and deliver results:

Timeline Note: The entire process typically takes 12-14 months from first contact to full implementation. The validation phase is risk-free and allows you to fully evaluate our approach before making any commitment.

Exclusive lifetime benefits, education access, and frameworks available only to founding members

Founding members receive exclusive lifetime benefits unavailable to future clients:

Your advisory fee is locked forever — never increases, regardless of market conditions or AUM growth. Future clients will pay current market rates.

Performance-based fee reduction as you achieve financial milestones. Our goal: make you financially self-reliant so fees eventually go to zero.

Exclusive Financial Freedom Operating System — Private Skool community, live Zoom workshops, quarterly KPI reviews, and framework templates. As education evolves, you evolve.

Guaranteed availability when capacity constraints arise. Founding members are never subject to waitlists or service limitations.

Direct advisor access with priority scheduling, faster response times, and personalized attention beyond standard service levels.

Pass to family members — Your founding benefits can be transferred to spouse, children, or designated beneficiaries.

Limited Availability: Founding memberships are strictly limited to ensure personalized service quality and maintain the exclusivity of the education community. Once capacity is reached, this opportunity closes permanently—future clients will pay higher fees and miss lifetime access to the Financial Freedom Operating System.

Founding members gain lifetime access to ECA's comprehensive Financial Freedom Operating System—far beyond traditional advisory services:

Beyond Strategies: Most advisors give you a plan and walk away. ECA operationalizes your financial freedom through ongoing education, proven frameworks, and community support—so you don't just execute once, you master the game for life.

Founding members master a complete toolkit of financial freedom frameworks that go far beyond ECA's proprietary strategies:

Track what matters: Investment Capital, Risk Capital, Cash Flow Generation, and Compounding with personalized quarterly targets

The core operating system: Leverage All Assets → Save Non-Value Expenses → Compound Every Dollar → Grow Entire Net Worth systematically

Prioritize with clarity: Survival → Emergencies → Discretionary → Big Tickets → Savings → Risk Capital

Think like a corporation: multiple income streams, tax optimization, compounding systems—not just salary and savings

Evaluate opportunities strategically: High-probability high-payoff (real estate, skills) vs. low-probability gambles (lottery, speculation)

Tax-advantaged deployment strategies—whole life mechanics, entity structuring, tax deferral techniques—to maximize net wealth accumulation

The Difference: You're not buying a one-time strategy. You're joining a wealth execution system with ongoing education, evolving frameworks, and lifetime community support. As markets, tax laws, and opportunities evolve—you evolve with them.

Understand capital requirements, passive income strategies, and wealth achievement process

Understanding capital requirements for passive income is critical for financial planning. Here's an educational comparison of different strategies to generate $100,000 in annual passive income—each with different tradeoffs in capital requirements, liquidity, and scalability:

| Strategy | Yield | Capital Needed | Scalable | Type | Liquidity | Perpetual |

|---|---|---|---|---|---|---|

| Stock Market Withdrawal | 4% | $2,500,000 | No | Passive | Yes | ~30 years |

| Dividend Income | 6% | $1,666,667 | No | Passive | Yes | No |

| Annuity | 7% | $1,428,571 | No | Passive | No | Yes |

| IUL Income | 8% | $1,250,000 | No | Passive | Yes | Yes |

| Rental Income | 8% | $1,250,000 | Yes | Semi-passive | No | May Be |

| Business Income | 30% | $333,333 | Yes | Semi-passive | No | No |

| EPIG Fund | 10% | $1,000,000 | Yes | Passive | Yes | ~30 Years |

| Ekantik Cash Flow | 20% | $500,000 | Yes | Passive | Yes | ~10 Years |

Key Insight: Higher-yield strategies like Ekantik Cash Flow (20% yield, $500K capital) and EPIG Fund (10% yield, $1M capital) can require significantly less capital than traditional approaches (like 4% stock withdrawals requiring $2.5M), while offering scalability, full passivity, and liquidity. ECA specializes in implementing these capital-efficient strategies for qualified investors.

Most ECA clients arrive with investable capital already established. Our process focuses on deploying that capital through EPIG 500, ECFS, and tax-efficient structures to reach agreed wealth targets within 10 years.

The Wealth Execution Cycle: This process creates a continuous improvement loop where each quarter builds on the last—setting wealth targets, deploying capital strategically, evaluating performance, optimizing allocation, and repeating. Over time, this systematic approach compounds both your wealth and your execution precision.

Learn how we're different, our philosophy, and what makes our approach unique

Ekantik Capital Advisors takes a fundamentally different approach:

Our Philosophy: Traditional advisors want you dependent forever (more AUM = more fees). ECA's goal is to make you financially self-reliant through ongoing education, proven frameworks, and community support. When you achieve true financial freedom, you can choose to hire an independent strategist or manage wealth yourself—because we've taught you how.

Take our 2-minute qualification survey to discover your best path:

Complete wealth execution system (ECFS + EPIG 500 + tax strategies + education)

Long-term growth strategy for capital appreciation

Learn More

Monthly cash flow strategy for reliable income

Learn More

✓ No obligation • Personalized recommendations • Instant results

Limited founding memberships available. Secure your lifetime benefits and begin your path to financial freedom.

First 25 members lock in lifetime benefits including:

After founding period closes: Standard members pay ~$259,038 more over 10 years and miss lifetime access to the Financial Freedom Operating System.

EPIG 500's Selective Exposure Strategy vs Traditional Buy-and-Hold

Example: Plan 1 (Direct Invest) vs Plan 2 (Whole Life + EPIG)